Many financial analysts use liquidity ratios to check the liquidity of the firm, many investors invest in that company where whose liquidity ratio is high, which means the company has enough cash to smoothen its operations, cash in hand is considered as the backbone of any company. You may also see Cash Book Template For Business.Professional Cash flow projection template excel let us first understand what the importance of cash in the firm’s cash is in the language of finance tell us the liquidity of the firm, liquidity is the position that how much a company is willing to pay cash. Because it contains a step-by-step guide for making cash flow.

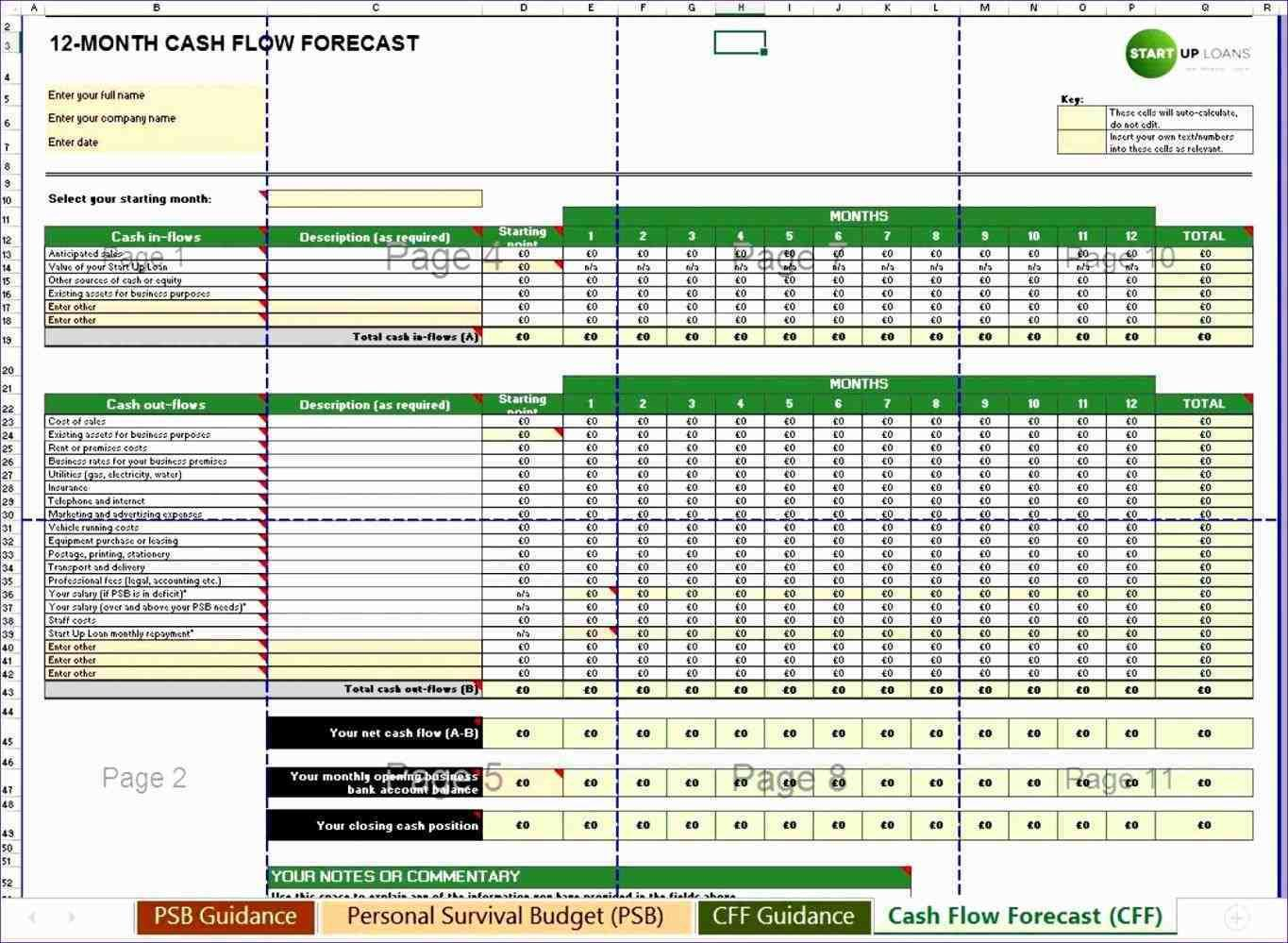

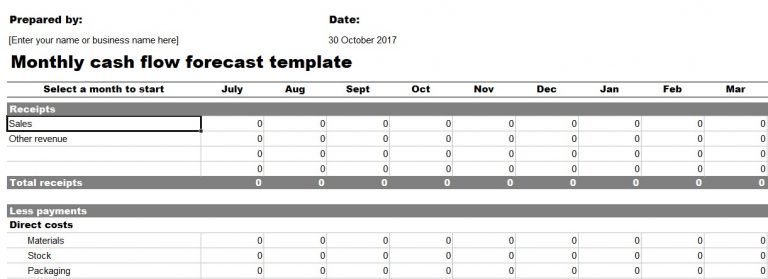

If you are preparing a cash budget template for the first time then this document helps you a lot. It describes the levied taxes, loan interest, and other expenses clearly. The elegant cash flow budget template helps you to make a detailed and monthly sample budget. It also contains instructions and projections that are made quarterly. This template contains a notes section that is used to emphasize the reason for allocating a particular amount for an expense. It is a detailed budget template for dairy and farm businesses. It also helps you to realize your business goals. Additionally, its format is simple and you can use it in all formats.

Cash flow projections template excel professional#

This professional template will save your time and money.

It is another type of cash flow budget template that is used for making a quarterly cash flow forecast for your business. You should also check the Cash Payment Receipt Template. You can use it to project you’re cash flows for six weeks. As its name implies, it is used to prepare a cash flow budget on weekly basis. It indicates cash received and cash disbursed and net cash flow. It is the cash flow analysis template that has a simple format. Different types of cash flow budget template: Weekly cash flow budget template: It serves as a rough guide on your future expenses. It is basically a rough map of how much money you should have at your fingertips at any particular time. Use the above data and then set the minimum cash flow balance. It provides you a peek into the outstanding balance. It indicates the difference between cash inflow and cash outflow. Now, you have to go ahead to compute the ending ash balance. If you don’t have past data then also leave it blank for sake of filling it out later. Likewise, cash inflows use the past data to make some projections on the future. You can fill it later when the cash inflows commence. If you don’t have past data right now, leave the column black. It must be in line with past trends and revenue inflows. Next, you have to move forward and project cash inflows. You may also like the Cash Flow Projection Template. You should keep in mind that this time frame is for sake of consistency in future budgeting procedures and techniques. Your timeframe can be monthly, annually, bi-weekly, or weekly. Take a start by setting a desirable timeframe for cash budgeting.

Here are some steps, tips, and procedures to do cash flow budgeting Desirable timeframe: To cater to any loopholes in budgeting.Cash flow budgeting is used to cater to the losses.It outlines the list of cash inflows and cash outflows.It displays the budget versus the cash flow.Cash flow budgeting enables you to know the status of the cash position at a certain time.Some of the reasons for cash flow budgeting are Different types of cash flow budget template:.

0 kommentar(er)

0 kommentar(er)